Payroll user guides

Payroll desktop

Functionality

Import Cost Centres and Departments

Copy Companies

Import Benefits

Adding a New Pay Element

Pay Rises

Modifying Custom Reports

Company and Employee Audit Trail

Maintaining Users and User Profiles

Automatic Pension Re-enrolment

Maintaining Elements and Relationships

Average Holiday Pay improvements

Change NI Table Letter

Loans and Save Schemes

Adding additional fields to payslips

Maintaining Display Views

Viewing RTI Submissions

Standard (STD) and Live Pay Period fields

Benefits - Car Allowance Optional Remuneration Arrangement (OpRA)

Average Holiday Pay

Changing Pay Groups

Statutory Neonatal Care Pay (SNCP) - desktop version

Release v2.52

COVID-19 changes to SSP

Class 1A NI contributions

CEO Pay reporting

Termination awards

New rules for low-emission cars

Hours and Days in Payroll

Employment Allowance changes

Parental Bereavement Pay

History generation for Pensions and Pay groups

IR35 Working rules

Holiday pay calculation changes

Changes to Pension re-enrolment

Printer names on RDP

Plain Paper P45s

Release v2.56

2.56 Release Report

Payroll version 2.56 Upgrade Instructions

Health and Social Care Levy message on the payslip

Support for the Alabaster ruling

Automatic recalculation of SMP,SPP etc

New NI Letters for freeports and veterans

HMRC gateway password saving

Release v2.58

Release v.2.61

Rolled up holiday pay for irregular hours and part-year workers

Statutory Paternity Pay (SPP) legislative update

Company Sick Pay (CSP)

Diary Changes for CSP

Working Patterns

Year End Guides

OVERVIEW - Payroll desktop version 2.58

DOC A - Payroll 2.58 Upgrade Instructions

DOC B - Payroll 2.58 Upgrade notes

DOC C - Copy Year-End Instructions v2.58

DOC D - Payroll v2.58 RTI Year-End Procedure

Elements of Pay

Errors and Troubleshooting

Payroll web

Manage Employees

Creating an Employee

Editing an Employee’s details

Viewing an employee’s payslips

Making an Employee a Leaver

Printing Employee P45s

Emailing Employee P45s

Change Employee NI Letter

Running Payroll

Starting a Payroll Cycle

Edit Pay Elements

Benefits

Cost Breakdown

Run Checks

Emailing Payslips (as part of running a payroll)

BACS/RTI

View Summary and close payroll

Restart Payroll cycle

Adding and Removing Employees from Payroll

Date Effective Processing

Statutory Payments

Statutory Payments

Statutory Maternity Pay (SMP)

Statutory Sick Pay

Import Sickness

Company Sick Pay (CSP) web functionality

Statutory Paternity Pay (SPP)

Import of Sick Pay information

Statutory Neonatal Care Pay (SNCP)

HMRC Messages

Month End

Permissions

General System Use

Reporting

Emailing in the web application

Importing Data

Backing up Data in Payroll

Support is Evolving

Product Hub

Release notes

20/01/2026 - Web v.2025.3, Desktop Version 2.63.3 hotfix

15/01/2026 - Web v.2025.3, Desktop Version 2.63.2

10/10/2025 - Web v.2025.2.3 hotfix

11/09/2025 - desktop v.2.63.1.1 hotfix

09/09/2025 - web v.2025.2.2 hotfix

08/09/2025 - Web v.2025.2.1 hotfix

29/08/2025 - Desktop v.2.63.1 hotfix

21/08/2025 - Web v.2025.2.0 and desktop v.2.63.0 release

06/03/2025 - Web v. 2025.1.0 & desktop v. 2.62.4 - Year-end release

12/12/2024 - Web v.5.8.1 release

14/11/2024 - Web v.5.8 release

03/10/2024 - Web v.5.7 release

04/07/2024 - Web v.5.6 and desktop v.2.61.4 release

16/04/2024 - Payroll - desktop v2.61.3.1 hotfix

27/03/2024- desktop v.2.61.3 - Year-end release

28/02/2024 - Web v.5.4 and desktop v2.61.1 Year-end release

11/12/2023 - desktop v.2.58.2 release

28/02/2023 - desktop v.2.58 - Year-end release

25/01/2023 - Web v.5.3 release

30/05/2022 - desktop v.2.56.2 release

24/10/2022 - desktop v.2.56.3 release

31/05/2022 - Web v.5.2 release

Year End Activities

Year-End Overview

Upgrading your system

Backing up your data

Running the installation program

Converting data directories that are not under the WINPAY directory

End of year overview (formerly RTI year-end procedure)

Last submission of the year

Print RTI amendments

Linked Companies

Year-end procedure

Update all payrolls and run check report

Copy year-end data instructions

EPS and final payments to HMRC

Print P60s

Starting the new tax year

Company year-end

Employee year-end

How to correct for a previous year

Clearing historical data (optional)

Scenarios

Pay Rises

OneAdvanced Payroll has a built-in utility to enable users to implement pay rises whether that is for one employee, a group, or all employees. This is done per element.

It is recommended that a backup is taken prior to applying pay rises: File>Back up data

This process should be done before a payroll cycle is opened.

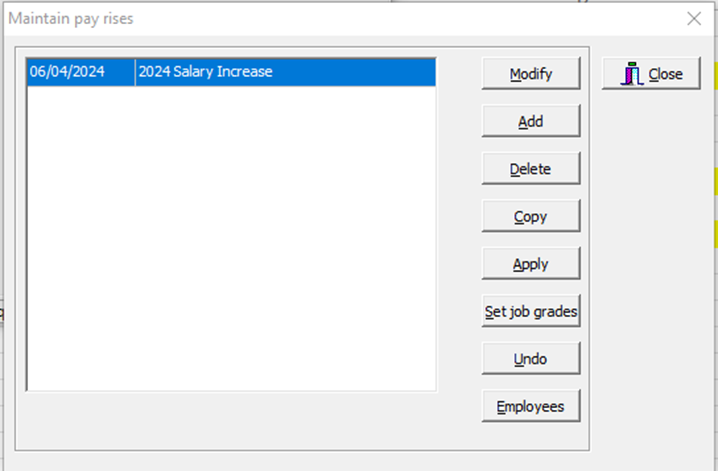

Navigate to ‘System>Maintain pay rises’ –

‘Add’ a pay rise, here you can select to apply to pay dates or paid dates from a specified date and whether the Alabaster Ruling applies to the increase.

You are able to select multiple elements to apply an increase to.

There are 3 types of pay rises:

· Add value – This adds the change amount on top of the existing amount.

· Percent rise – This increases the value by the percentage entered in change amount.

· Set value – This changes the value to whatever is set in the change amount.

It is important to note that if you are implementing an increase to an element with a standard relationship, the increase should be applied to the STD field while the payroll cycle is closed and not the live field.

After the rise has been added, you must ‘Apply’ the rise, selecting apply will provide you with the option to select the employees the rise is applicable for.

it is also important to understand whether an existing field is being set by a custom calculation or set from another field. It is therefore important to take a backup and ensure each increase is operating as you would expect them to after applying.