Payroll user guides

Payroll desktop

Functionality

Import Cost Centres and Departments

Copy Companies

Import Benefits

Adding a New Pay Element

Pay Rises

Modifying Custom Reports

Company and Employee Audit Trail

Maintaining Users and User Profiles

Automatic Pension Re-enrolment

Maintaining Elements and Relationships

Average Holiday Pay improvements

Change NI Table Letter

Loans and Save Schemes

Adding additional fields to payslips

Maintaining Display Views

Viewing RTI Submissions

Standard (STD) and Live Pay Period fields

Benefits - Car Allowance Optional Remuneration Arrangement (OpRA)

Average Holiday Pay

Changing Pay Groups

Statutory Neonatal Care Pay (SNCP) - desktop version

Release v2.52

COVID-19 changes to SSP

Class 1A NI contributions

CEO Pay reporting

Termination awards

New rules for low-emission cars

Hours and Days in Payroll

Employment Allowance changes

Parental Bereavement Pay

History generation for Pensions and Pay groups

IR35 Working rules

Holiday pay calculation changes

Changes to Pension re-enrolment

Printer names on RDP

Plain Paper P45s

Release v2.56

2.56 Release Report

Payroll version 2.56 Upgrade Instructions

Health and Social Care Levy message on the payslip

Support for the Alabaster ruling

Automatic recalculation of SMP,SPP etc

New NI Letters for freeports and veterans

HMRC gateway password saving

Release v2.58

Release v.2.61

Rolled up holiday pay for irregular hours and part-year workers

Statutory Paternity Pay (SPP) legislative update

Company Sick Pay (CSP)

Diary Changes for CSP

Working Patterns

Year End Guides

OVERVIEW - Payroll desktop version 2.58

DOC A - Payroll 2.58 Upgrade Instructions

DOC B - Payroll 2.58 Upgrade notes

DOC C - Copy Year-End Instructions v2.58

DOC D - Payroll v2.58 RTI Year-End Procedure

Elements of Pay

Errors and Troubleshooting

Payroll web

Manage Employees

Creating an Employee

Editing an Employee’s details

Viewing an employee’s payslips

Making an Employee a Leaver

Printing Employee P45s

Emailing Employee P45s

Change Employee NI Letter

Running Payroll

Starting a Payroll Cycle

Edit Pay Elements

Benefits

Cost Breakdown

Run Checks

Emailing Payslips (as part of running a payroll)

BACS/RTI

View Summary and close payroll

Restart Payroll cycle

Adding and Removing Employees from Payroll

Date Effective Processing

Statutory Payments

Statutory Payments

Statutory Maternity Pay (SMP)

Statutory Sick Pay

Import Sickness

Company Sick Pay (CSP) web functionality

Statutory Paternity Pay (SPP)

Import of Sick Pay information

Statutory Neonatal Care Pay (SNCP)

HMRC Messages

Month End

Permissions

General System Use

Reporting

Emailing in the web application

Importing Data

Backing up Data in Payroll

Support is Evolving

Product Hub

Release notes

20/01/2026 - Web v.2025.3, Desktop Version 2.63.3 hotfix

15/01/2026 - Web v.2025.3, Desktop Version 2.63.2

10/10/2025 - Web v.2025.2.3 hotfix

11/09/2025 - desktop v.2.63.1.1 hotfix

09/09/2025 - web v.2025.2.2 hotfix

08/09/2025 - Web v.2025.2.1 hotfix

29/08/2025 - Desktop v.2.63.1 hotfix

21/08/2025 - Web v.2025.2.0 and desktop v.2.63.0 release

06/03/2025 - Web v. 2025.1.0 & desktop v. 2.62.4 - Year-end release

12/12/2024 - Web v.5.8.1 release

14/11/2024 - Web v.5.8 release

03/10/2024 - Web v.5.7 release

04/07/2024 - Web v.5.6 and desktop v.2.61.4 release

16/04/2024 - Payroll - desktop v2.61.3.1 hotfix

27/03/2024- desktop v.2.61.3 - Year-end release

28/02/2024 - Web v.5.4 and desktop v2.61.1 Year-end release

11/12/2023 - desktop v.2.58.2 release

28/02/2023 - desktop v.2.58 - Year-end release

25/01/2023 - Web v.5.3 release

30/05/2022 - desktop v.2.56.2 release

24/10/2022 - desktop v.2.56.3 release

31/05/2022 - Web v.5.2 release

Year End Activities

Year-End Overview

Upgrading your system

Backing up your data

Running the installation program

Converting data directories that are not under the WINPAY directory

End of year overview (formerly RTI year-end procedure)

Last submission of the year

Print RTI amendments

Linked Companies

Year-end procedure

Update all payrolls and run check report

Copy year-end data instructions

EPS and final payments to HMRC

Print P60s

Starting the new tax year

Company year-end

Employee year-end

How to correct for a previous year

Clearing historical data (optional)

Scenarios

- All Categories

- Payroll user guides

- Payroll web

- Running Payroll

- Adding and Removing Employees from Payroll

Adding and Removing Employees from Payroll

Updated

by Karishma

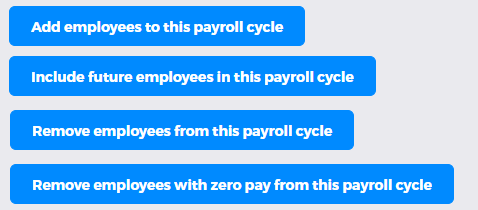

Sometimes, during a Payroll cycle, you may need to make amendments to the Employees currently being processed. Payroll offers several distinct ways to achieve this, depending on the different situations you may have:

- Add employee(s) to an existing Payroll cycle, for situations where you have New starters that are added to Payroll following the start of the Payroll cycle

- Include employee(s) for future pay periods will allow you to add an Employee to a Payroll cycle when their start date is after the end of the current Payroll cycle – for example, a New starter for the following month that actually started in the current Payroll cycle

- Do not pay employee(s) for this period is for removing an Employee entirely from the Payroll cycle

- Do not pay employee(s) with zero pay will give the option to select and remove any Employee that has no pay for the current Payroll cycle, which is useful to prevent producing Payslips and overhead admin for Employees that are not actually earning anything in the current Payroll cycle

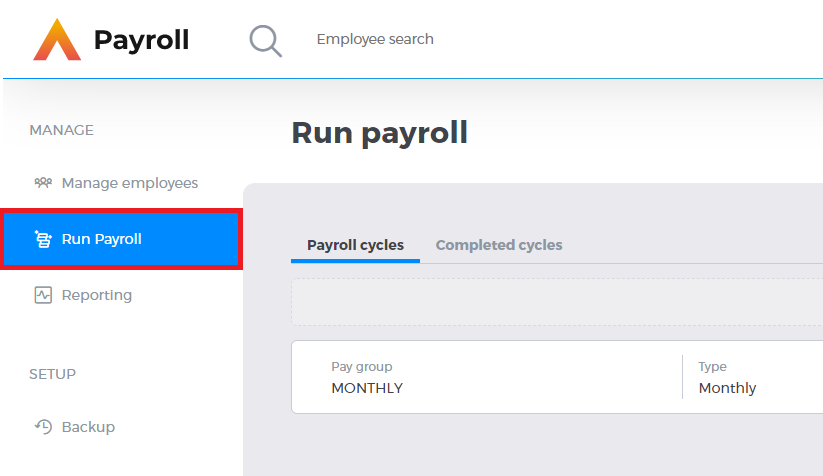

These options are all available for Payroll cycles that are already open. To start, open the Run payroll menu on the Payroll navigation bar to display a list of your open Payroll cycles:

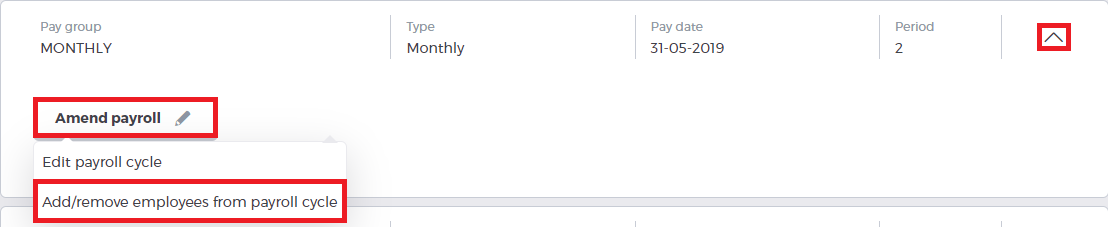

Then, choose the Payroll cycle that you wish to modify on the Payroll cycles tab, and use the arrow to expand it. Once expanded, click the Amend payroll button. Then, click Add/remove employees from payroll cycle:

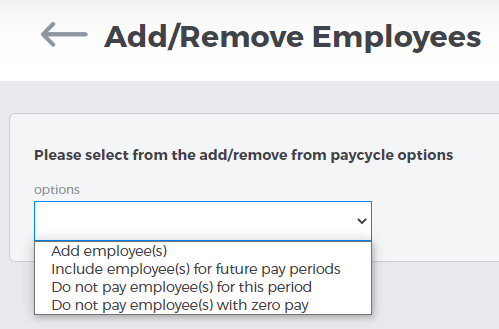

Then, the Add/Remove Employees page will open. From here, you can use the drop-down menu to choose which of the above 4 options to use:

Each option will limit the Employees that you can choose, and will filter out Employees that are not applicable to the chosen option:

- Add employee(s) will limit the selection to Employees not in the current Payroll cycle

- Include employees for future pay periods will limit the selection to Future starters that are not in the current Payroll cycle

- Do not pay employee(s) for this period will limit the selection to Employees that are currently in the Payroll cycle

- Do not pay employee(s) with zero pay will limit the selection to Employees in the current Payroll cycle that will not be paid anything

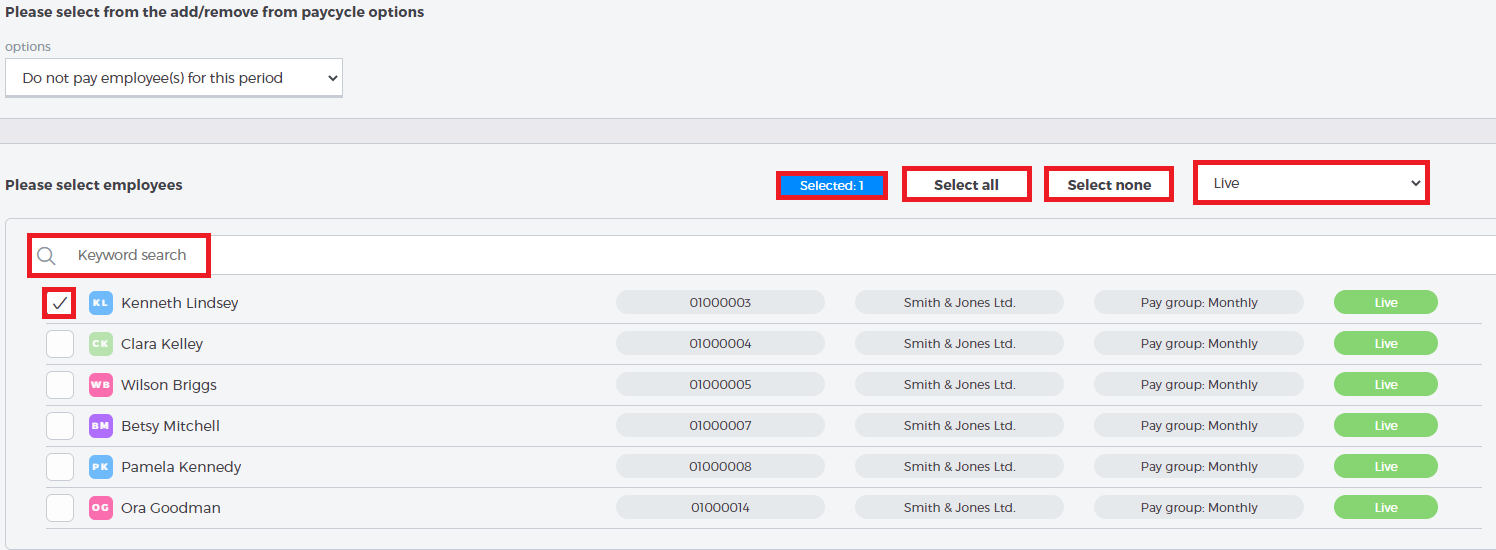

Once you have chosen which option to use, a Select employees section will appear. There are several tools you can use on this section to filter and find Employees:

- Keyword search – there is a search bar that you can use to search for an Employee by their first name, last name, or Employee number

- Select all – this button will select all Employees that match the criteria listed above for your chosen option

- Select none – this button will clear your selected Employees

- Employee status drop-down menu – you can use this drop-down menu to limit your available selections to an Employee’s status, e.g. Live, Leaver, Future Starter, Leaver with additional payment

To add an Employee to the current selection, tick the checkbox next to their name. The selection counter will keep a tally of how many Employees have been selected:

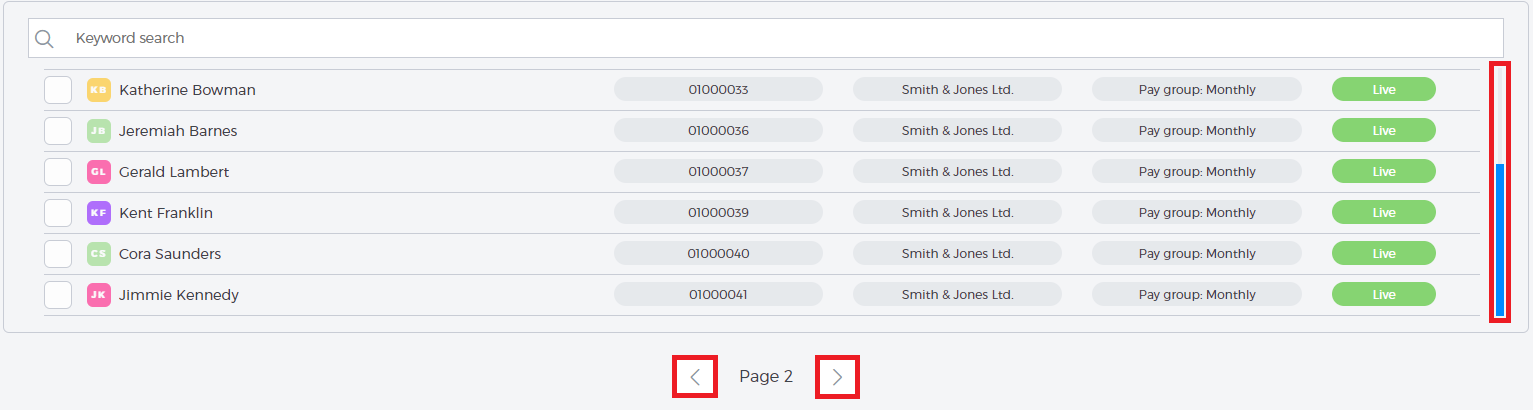

Employees are displayed in ascending order by their Employee number. You may find that if you have a lot of options, not all of your available Employees will appear on the screen. There may be a scrollbar on the right-hand side of the Employee selection, as well as a page counter at the bottom. Each page of Employees will display up to 10 Employees. To go to a different page of Employees, click the left and right arrows to move backwards and forwards:

Once you have made your selection, click the blue button at the bottom of the page to confirm the selection and perform the applicable action. The text on the button will differ based on what action you are performing:

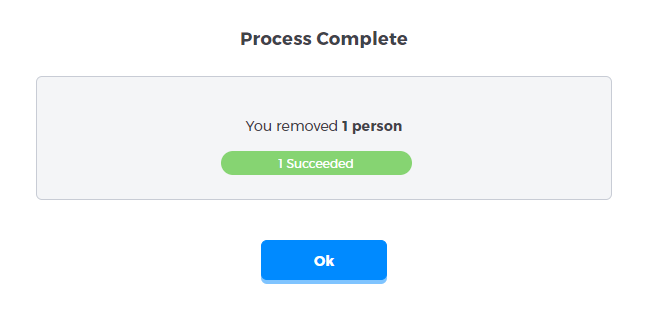

Once you have confirmed the selection, a confirmation box will appear telling you how many Employees have been added or removed. Press OK to continue:

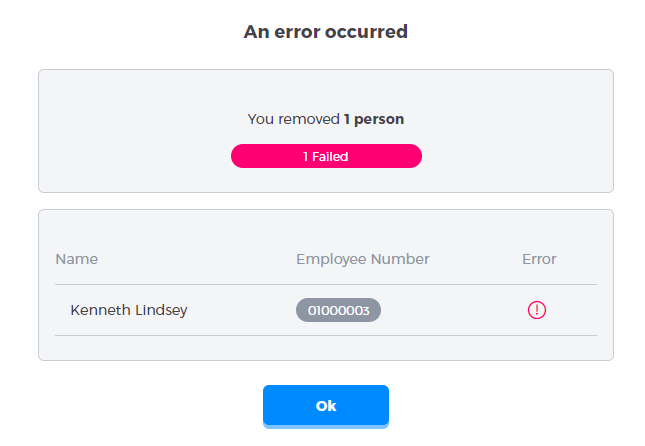

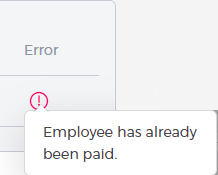

If you encounter errors during this process, Payroll will also detail them on this screen:

Hovering your mouse over the red exclamation mark will explain why this error occurred. Any errored Employees will not be removed from the Payroll cycle:

Another error that may occur is when trying to add an Employee to a Payroll cycle who has already been removed from it before. If this error occurs, you will need to Recalculate the payroll. Currently, this can only be achieved in Payroll desktop version.