Payroll user guides

Payroll desktop

Functionality

Import Cost Centres and Departments

Copy Companies

Import Benefits

Adding a New Pay Element

Pay Rises

Modifying Custom Reports

Company and Employee Audit Trail

Maintaining Users and User Profiles

Automatic Pension Re-enrolment

Maintaining Elements and Relationships

Average Holiday Pay improvements

Change NI Table Letter

Loans and Save Schemes

Adding additional fields to payslips

Maintaining Display Views

Viewing RTI Submissions

Standard (STD) and Live Pay Period fields

Benefits - Car Allowance Optional Remuneration Arrangement (OpRA)

Average Holiday Pay

Changing Pay Groups

Statutory Neonatal Care Pay (SNCP) - desktop version

Statutory Parental Bereavement Pay for Northern Ireland (SPBPNI)

Statutory Sick Pay (SSP) Changes April 2026

Release v2.52

COVID-19 changes to SSP

Class 1A NI contributions

CEO Pay reporting

Termination awards

New rules for low-emission cars

Hours and Days in Payroll

Employment Allowance changes

Parental Bereavement Pay

History generation for Pensions and Pay groups

IR35 Working rules

Holiday pay calculation changes

Changes to Pension re-enrolment

Printer names on RDP

Plain Paper P45s

Release v2.56

2.56 Release Report

Payroll version 2.56 Upgrade Instructions

Health and Social Care Levy message on the payslip

Support for the Alabaster ruling

Automatic recalculation of SMP,SPP etc

New NI Letters for freeports and veterans

HMRC gateway password saving

Release v2.58

Release v.2.61

Rolled up holiday pay for irregular hours and part-year workers

Statutory Paternity Pay (SPP) legislative update

Company Sick Pay (CSP)

Diary Changes for CSP

Working Patterns

Year End Guides

OVERVIEW - Payroll desktop version 2.58

DOC A - Payroll 2.58 Upgrade Instructions

DOC B - Payroll 2.58 Upgrade notes

DOC C - Copy Year-End Instructions v2.58

DOC D - Payroll v2.58 RTI Year-End Procedure

Elements of Pay

Errors and Troubleshooting

Payroll web

Manage Employees

Creating an Employee

Editing an Employee’s details

Viewing an employee’s payslips

Making an Employee a Leaver

Printing Employee P45s

Emailing Employee P45s

Change Employee NI Letter

Running Payroll

Starting a Payroll Cycle

Edit Pay Elements

Benefits

Cost Breakdown

Run Checks

Emailing Payslips (as part of running a payroll)

BACS/RTI

View Summary and close payroll

Restart Payroll cycle

Adding and Removing Employees from Payroll

Date Effective Processing

Statutory Payments

Statutory Payments

Statutory Maternity Pay (SMP)

Statutory Sick Pay

Import Sickness

Company Sick Pay (CSP) web functionality

Statutory Paternity Pay (SPP)

Import of Sick Pay information

Statutory Parental Bereavement Pay (SPBP) and Statutory Parental Bereavement Pay for Northern Ireland (SPBPNI)

Statutory Neonatal Care Pay (SNCP)

HMRC Messages

Month End

Permissions

General System Use

Reporting

Emailing in the web application

Importing Data

Backing up Data in Payroll

Support is Evolving

Product Hub

Release notes

05/03/2026 - Web v. 2026.1.0 & desktop v. 2.64.0 - Year-end release

20/01/2026 - Web v.2025.3, Desktop Version 2.63.3 hotfix

15/01/2026 - Web v.2025.3, Desktop Version 2.63.2

10/10/2025 - Web v.2025.2.3 hotfix

11/09/2025 - desktop v.2.63.1.1 hotfix

09/09/2025 - web v.2025.2.2 hotfix

08/09/2025 - Web v.2025.2.1 hotfix

29/08/2025 - Desktop v.2.63.1 hotfix

21/08/2025 - Web v.2025.2.0 and desktop v.2.63.0 release

06/03/2025 - Web v. 2025.1.0 & desktop v. 2.62.4 - Year-end release

12/12/2024 - Web v.5.8.1 release

14/11/2024 - Web v.5.8 release

03/10/2024 - Web v.5.7 release

04/07/2024 - Web v.5.6 and desktop v.2.61.4 release

16/04/2024 - Payroll - desktop v2.61.3.1 hotfix

27/03/2024- desktop v.2.61.3 - Year-end release

28/02/2024 - Web v.5.4 and desktop v2.61.1 Year-end release

11/12/2023 - desktop v.2.58.2 release

28/02/2023 - desktop v.2.58 - Year-end release

25/01/2023 - Web v.5.3 release

30/05/2022 - desktop v.2.56.2 release

24/10/2022 - desktop v.2.56.3 release

31/05/2022 - Web v.5.2 release

Year End Activities

Year-End Overview

Upgrading your system

Backing up your data

Running the installation program

Converting data directories that are not under the WINPAY directory

End of year overview (formerly RTI year-end procedure)

Last submission of the year

Print RTI amendments

Linked Companies

Year-end procedure

Update all payrolls and run check report

Copy year-end data instructions

EPS and final payments to HMRC

Print P60s

Starting the new tax year

Company year-end

Employee year-end

How to correct for a previous year

Clearing historical data (optional)

Scenarios

- All Categories

- Payroll user guides

- Payroll desktop

- Release v2.52

- History generation for Pensions and Pay groups

History generation for Pensions and Pay groups

Updated

by Karishma

Payroll will now generate a history of data for Pensions and Pay groups. This is to supplement the employee archive records so a more accurate history of your Payroll calculations is maintained. This will begin taking snapshots of your Pension and Pay group settings and storing them.

Pensions

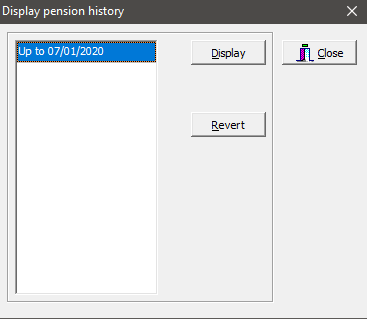

On the Maintain pensions window, which is accessed by clicking Maintain pensions under the system menu, there is a new button labelled History. Clicking this button brings up a History of any changes made to the Pension from this version onwards:

Clicking Display will show you the settings for the Pension before the selected date of change.

Clicking Revert will change the Pension back to the most recent history’s settings.

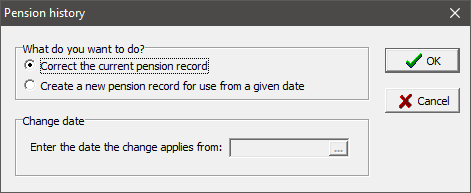

Changes are recorded when updating Pensions. When altering a Pension, after clicking OK to save your changes, Payroll will prompt you to pick one of two options:

Clicking Correct the current pension record will simply change the current Pension and not create a new history. This is used for situations where a mistake has been made – for example, if a typo appeared in the title.

The second option will prompt you to enter a date at the bottom of the window, and will save the values before the changes were made as a new History record, ending the day before the selected date.

Click OK to update the current record, and save the History if this option was selected.

Pay Groups

During Update pay cycle, Payroll will automatically take a snapshot of the Pay group, and save it as a history.