HMRC Messages Menu

Updated

by Karishma

The HMRC messages functionality within Payroll web version 5.3 makes available and builds on functionality previously only available in the desktop version. The module allows for the downloading and matching of tax codes and student and postgraduate loan notices to the correct employees that can then be applied at a time of your choosing. Incorporated in this is a new system notification system that will let users know when there are unmatched HMRC messages.

HMRC Messages Menu

There is a new menu item on the left hand panel called HMRC Messages

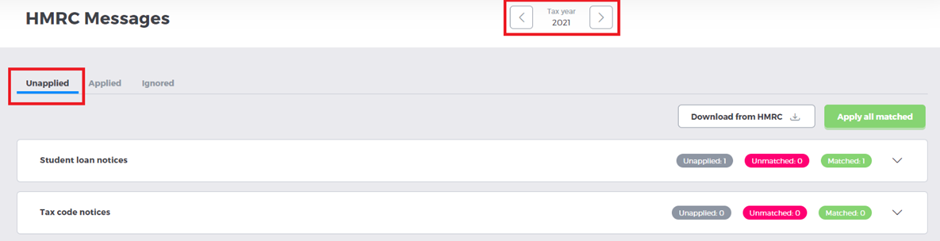

Within this new menu item, the page will default to the current financial year showing the Unapplied tab.

You can use the arrows either side of tax year to move forward and back a tax year.

HMRC Messages Screen tabs

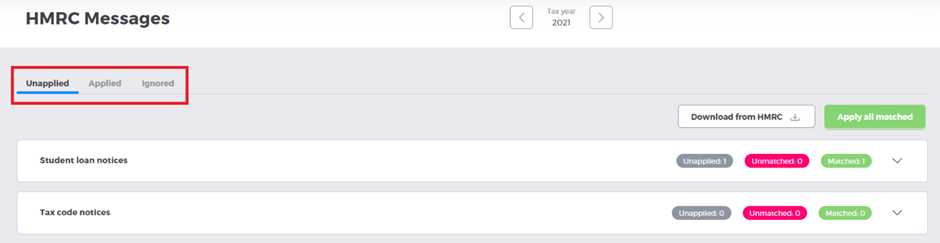

There are three tabs on the new HMRC messages screen which show all HMRC messages received within the tax year selected.

Each of the tabs shows the main status of the messages: Unapplied, Applied and Ignored.

The Unapplied tab shows HMRC notifications that have an effective date within the selected tax year and have not yet been applied.

The Applied tab shows HMRC notifications that have been applied to employees within the tax year selected

The Ignored tab shows HMRC notifications within the selected tax year that have been overridden so that the tax code or student/ postgraduate loan notification is not applied to the employee’s record.

Unapplied Tab

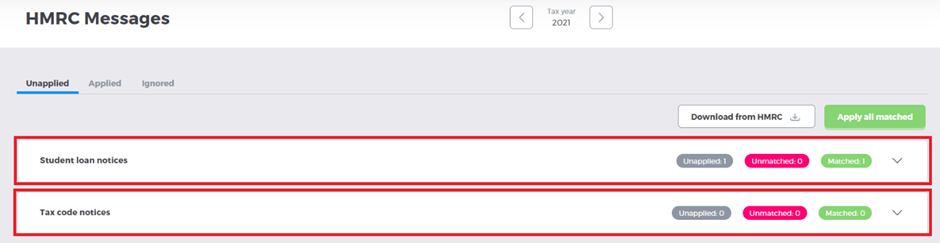

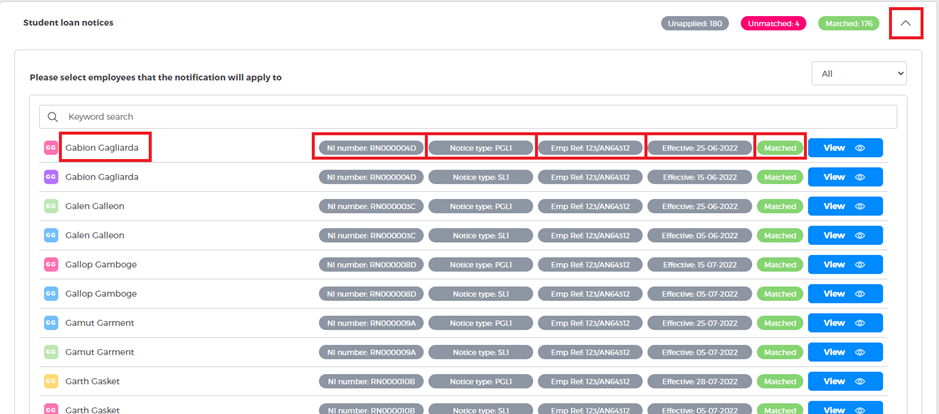

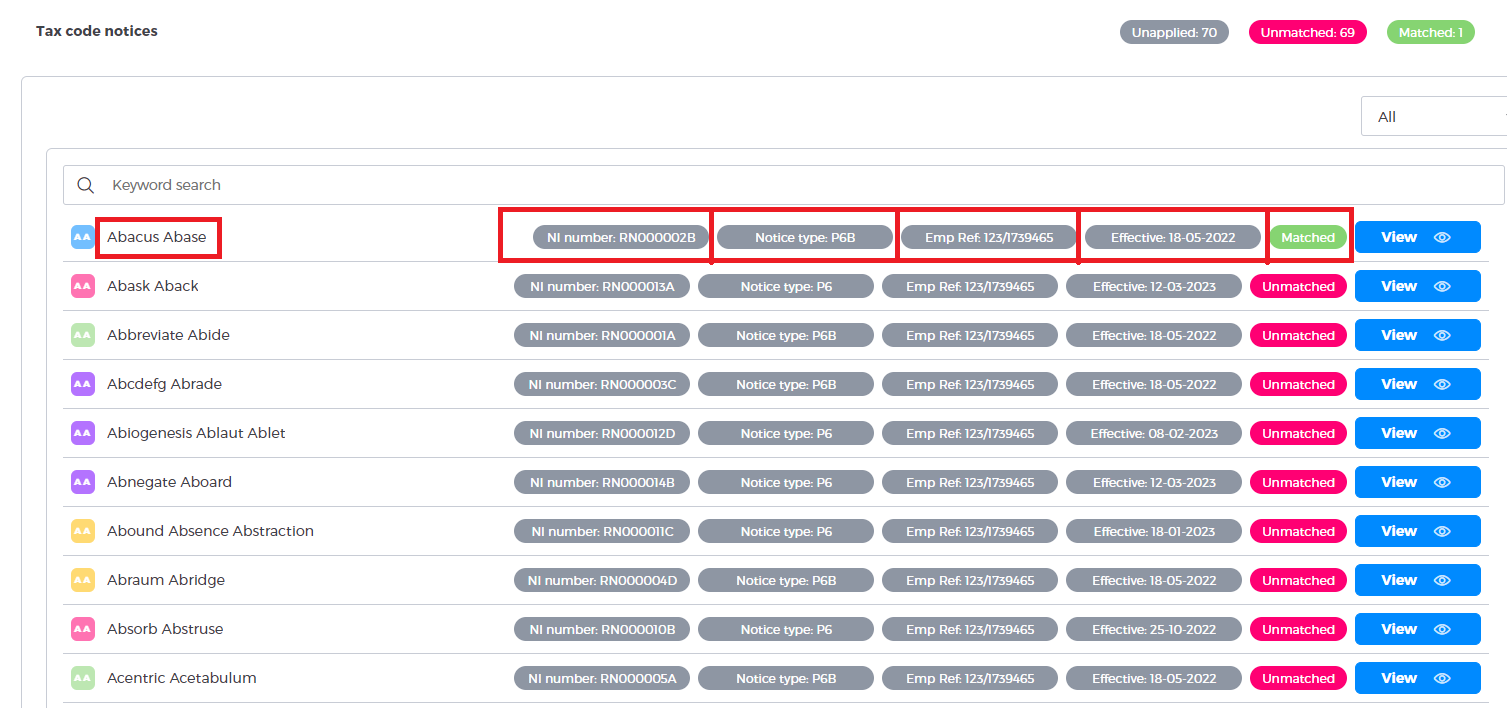

Within each tab there are two panels, one showing student (and postgraduate) loan notices and one showing tax code notices.

There are three information chips on each panel, showing the count of the HMRC messages in each specific status. The three statuses within the Unapplied tab are: Unapplied, Unmatched and Matched.

Unapplied

The Unapplied grey chip shows the total count of all messages in that type (Student Loan or Tax Code) that are in the Unapplied tab.

Unmatched

The Unmatched pink chip shows the count of the HMRC messages that cannot be matched against a corresponding employee. When the HMRC messages are downloaded, they are automatically run through a matching program that looks at the employer reference, NI number and works number sent across on the HMRC message and looks for an employee with the corresponding details. If one is found, it is matched against this employee. If these details don’t match or there for whatever reason are any duplicates the message will remain in an unmatched state.

Matched

The Matched green chip shows the count of HMRC messages that have been successfully linked to a corresponding employee.

Notification Type Cards

By clicking on the down arrow at the end of either the Student loan notices panel or Tax code notices panel, it will expand to display the individual notices from HMRC.

The information displayed on each row is the information received from HMRC and not the employee it has been linked to. The information displayed from the HMRC notice is the name, the NI number, employer reference and effective date. It also shows whether the notification has been matched to an employee or not.

You can use the filter drop down underneath the information chips to filter the notices based on the different statuses.

To see a more detailed view of the messages, and to match or ignore any unmatched, click the view icon at the end of the row you want to view.

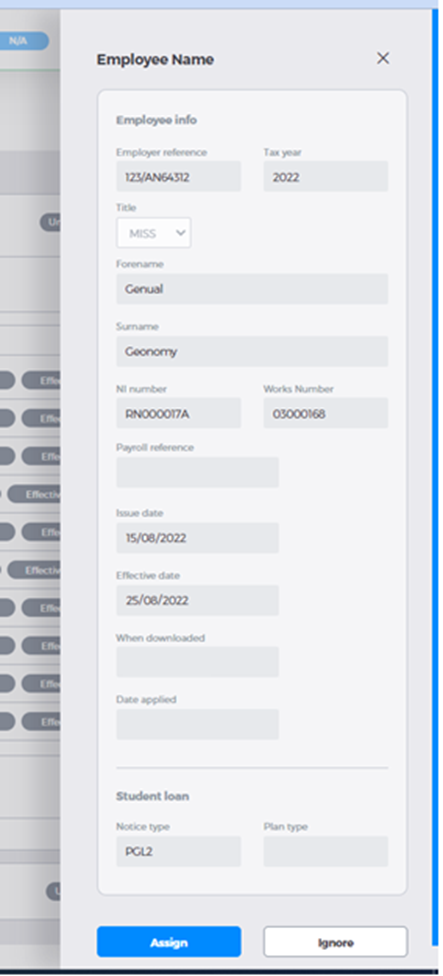

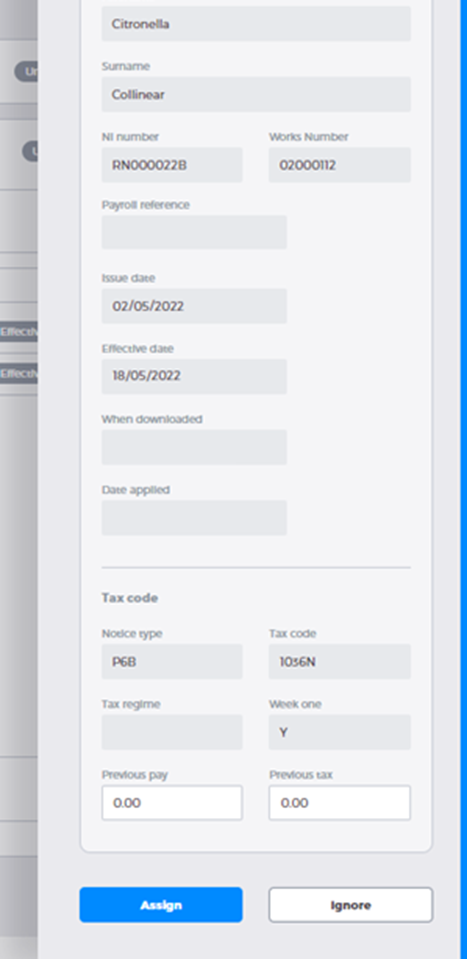

When expanded the user is presented with a side modal showing all the information that is sent from HMRC.

Side modal for Student loan notices

Side Modal for tax code changes

If the message is unable to have been matched via the matching process, you can choose to manually assign or ignore the message.

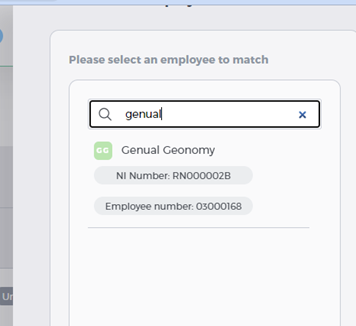

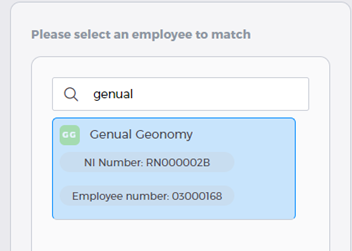

To manually match the message to an employee, you click the Assign button at the bottom of the modal which updates the view to allow the user to search for the correct employee to apply to.

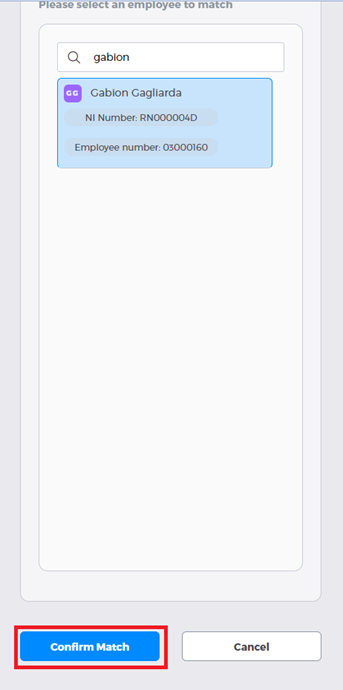

For each employee listed you can see their name, NI number and employee number.

Clicking on the employee card highlights the employee, which then allows you to manually match the employee to the HMRC message at the bottom of the modal by clicking the Confirm Match button.

Download from HMRC

Clicking the Download from HMRC button will trigger the program to poll the HMRC gateway and download any new HMRC messages.

A prerequisite of using this functionality is ensuring that your HMRC password is saved in the system. Instruction on how to do this can be found here.

Once clicked, the program will run in the background and will take a moment or so. Refreshing the screen will update the cards to show any new messages that have been pulled through.

Apply all matched

Clicking the Apply all matched button allows you to apply all HMRC messages that are in a matched state. For tax codes, the effective date must be before the payroll cut off. Student and postgraduate loan notices will apply at any time within the relevant tax year.

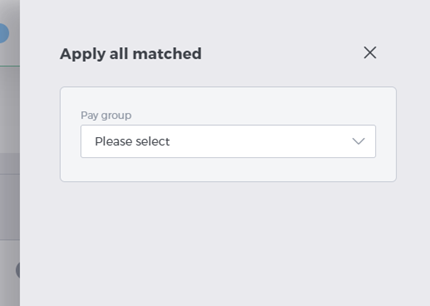

Upon clicking, a side modal appears asking the user to select a pay group:

When selected a save button appears allowing the user to finalise applying the messages.

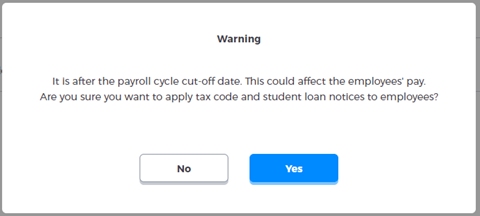

Selecting the Pay group is required as the system checks whether there is an active pay cycle open and whether it is after the payroll cut-off date. If it is after the payroll cut-off date, then the following warning message displays.

Those HMRC messages that have an effective date before the payroll cut off can still be applied if so desired, but it is up to the user to decide.

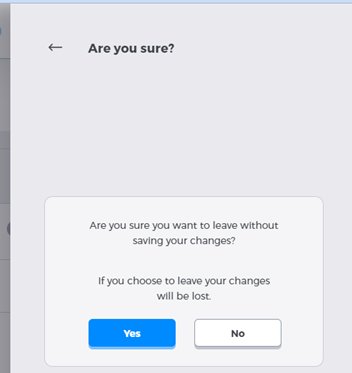

If you click the back arrow button at the top of the modal then you will presented with the following message asking if you are sure you want to leave without applying the messages.

Clicking Yes will close the modal without applying any of the messages from HMRC.

Clicking No will return back to the Apply all matched open modal.

You also have the option of applying notices from within the payroll cycle. To view this article click here.

Changes can also be viewed from an employees record. To view this article click here.