06/03/2025 - Web v. 2025.1.0 & desktop v. 2.62.4 - Year-end release

Updated

by Matt Jennings

We are pleased to announce the latest release of Payroll for web version 2025.1.0 and desktop version 2.62.4

Release history

Release number | Release Date | Notes |

Web: 2025.1.1 | 31/07/2025 |

|

Desktop: 2.62.4 | 09/05/2025 |

|

Desktop: 2.62.3 | 27/03/2025 |

This hotfix will be rolled up into the next main release |

Desktop: 2.62.2 | 21/03/2025 |

This hotfix will be rolled up into the next main release |

Desktop: 2.62.1 | 18/03/2025 |

|

Web: 2025.1.0 Desktop: 2.62.0 | 06/03/2025 |

|

These release notes will guide you through what's new in Payroll and provide guidance on how to upgrade your Payroll software to version 2.62 (if you run the desktop version) as well as the year end instructions. For hosted and web customers, we will upgrade your system to the correct version.

There will be articles covering:

- How to perform the software update (desktop customers only)

- The new features (which are also summarised below)

- How to copy your year-end data

- How to perform the year-end

https://www.gov.uk/business-tax/paye

https://www.gov.uk/payroll-annual-reporting

Please read all of the guidance before proceeding with the upgrade. There is no corresponding Time & Attendance upgrade this year.

Please refer to Year-End Overview for what you need to do next. (Customers with the Payroll desktop version will need to perform the upgrade.

New Features

- New statutory parameters

What have we done?

This release of Payroll included changes to statutory parameters, correct for tax year 2025/2026, as known at the time of release. These include Tax, National Insurance, Statutory payments and benefits.

This includes the increase in Employers National Insurance contributions to 15%, reduction in secondary threshold, Scottish tax threshold changes, Scottish AOE update, increase in employment allowance to £10,500 and NIC reclaim for small employers on statutory payments has been increased to 8.5%

Why have we done this?

To ensure the system remains up to date with current legislation

How will you benefit?

Continued legislative compliance

- RTI submission changes

What have we done?

Schemas have been updated to cover RTI submissions for the 2025/2026 tax year

Why have we done this?

To ensure the system remains up to date with current legislation

How will you benefit?

Continued legislative compliance

Details of the change

RTI submissions have been updated to submit for the new tax year, as well as including new data items for SNCP and Employee workplace postcode

- Statutory Neonatal Care Pay (SNCP)

What have we done?

We have updated the system to allow the running of Statutory Neonatal Care Pay (SNCP) in both the desktop and web systems.

Why have we done this?

To ensure the system remains up to date with current legislation

How will you benefit?

Continued legislative compliance

Details of the change

To view the article for SNCP functionality in the web click HERE

To view the article for SNCP functionality in the desktop version click HERE

- Employee Workplace Postcode

What have we done?

For employees who have a freeport or investment zone NI letter, it is now mandatory that the employees workplace postcode is submitted on the FPS

Why have we done this?

To ensure the system remains up to date with current legislation

How will you benefit?

Continued legislative compliance

Details of the change

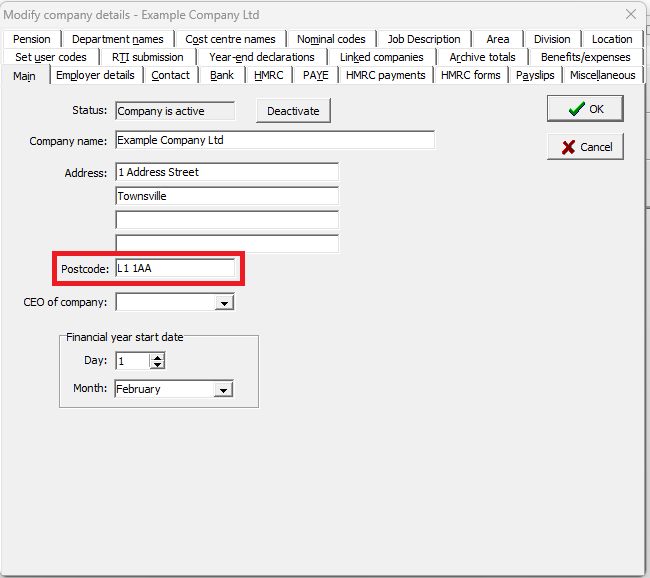

We have added a new field in the system called Employee workplace postcode. For employees who have a freeport or investment zone NI letter, as a default the postcode set against the company will be submitted as a default. To access this, in the desktop version, click Company>Maintain details then select the company and click Modify. From within the company select the Main tab.

If you have multiple sites, or the site is different to the company postcode, you can set this at employee level.

To set this in the desktop version you will need to add the field onto a display view, and update on each employee.

To set this in the web version, you can edit this on the employee record on the Personal tab, in the Job details card. There is a tooltip here to provide information that the field is used for.

- Improved information shown on the About screen

What have we done?

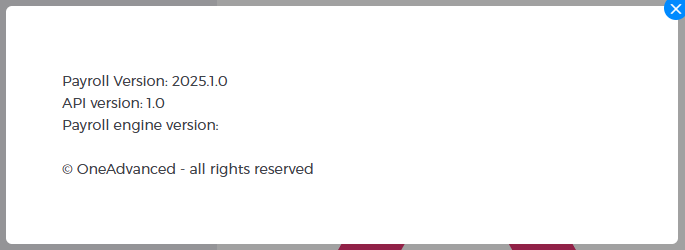

We have updated the information shown in the About screen

Why have we done this?

So you can see more relevant information about the current version

How will you benefit?

This information can be useful to support when diagnosing any potential issues

Details of the change

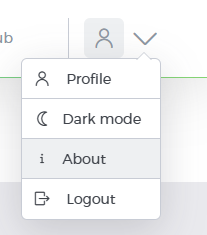

In the top right of the web system, you can find the About menu. Here you can see the current web version, the API version and the Payroll engine version (this indicates the desktop version running on the Virtual Machine).

- New pension payroll indicators

What have we done?

Added support for the new pension indicators Pension commencement lump sum indicator and Stand alone lump sum indicator

Why have we done this?

To ensure the system remains up to date with current legislation

How will you benefit?

Continued legislative compliance

Details of the change

Added support for the new pension indicators Pension commencement lump sum indicator and Stand alone lump sum indicator from within a pension a pension payroll

- Various Bug fixes

What have we fixed?

- Fixed issue where cookies needed periodically deleting in order to log into the system

- Fixed issue where navigating to another employee when save process is running on payroll could cause data writing to the second employee in error

- Fixed issue where navigating to another employee record from manage employees doesn't load the new data

Please read all of the guidance before proceeding with the upgrade.

Please refer to Year-End Overview for what you need to do next. (Customers with the Payroll desktop version will need to perform the upgrade.